Introduction of Paytm Share Price:

Over the years, Paytm has emerged as one of India’s leading digital payment platforms, inspiring the way people conduct financial transactions. As the company continues to grow and develop, Paytm’s share price has become a point of interest for investors. There has been growth of 23% with an average Monthly Transaction User of 9.2 crore. In this Paytm insider article, we will take a closer look at the Paytm share price, the factors affecting its movement and the Future prospects of this dynamic company.

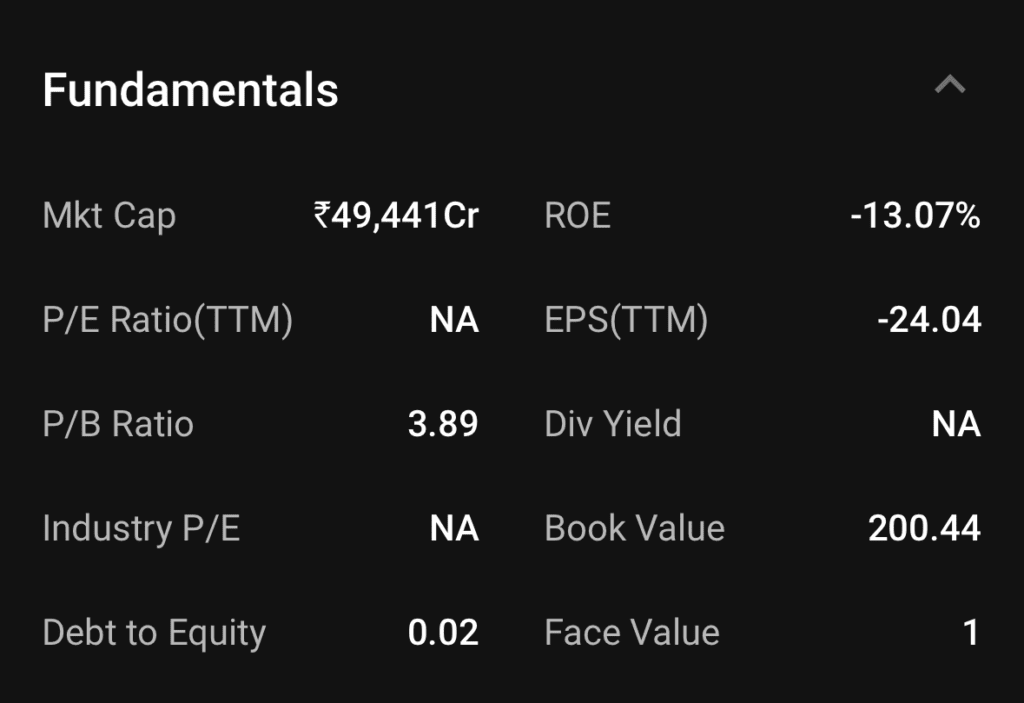

Performance of Paytm in the stock market

The share price of a company reflects its overall performance and potential. Being a publicly traded company, Paytm share prices are determined by market forces and investor sentiment. Analysis of historical share price movements and financial reports can provide valuable insight into a company’s past records. IPO, quarterly earnings reports, business expansion, user engagement metrics, continuous changes and the overall economic environment have all played a significant role in increasing Paytm share price.

Factors Affecting Paytm Share Price:

Several factors may affect Paytm share price, including its financial performance, market competition, regulatory environment and overall economic conditions. Investors need to consider these factors when assessing the potential risks and rewards associated with investing in Paytm according to paytm insider.

A. Financial performance:

Revenue growth, profitability and overall financial health especially affect Paytm share price. Positive financial results are likely to attract investors and move the share price upwards.

B. Market Perception:

Market perceptions and sentiments can affect the confidence of investors. Paytm share price can be ups and downs by these perceptions and sentiments. Positive news and developments can lead to Paytm share price, while negative events may decrease.

C. Competition and Industry Trends:

In a competitive industry like digital payments, competitors’ work and performance can affect investors’ decisions, indirectly affecting Paytm share price.

D. Regulatory Environment:

Changes in rules or government policies related to digital payments can affect Paytm’s operation and paytm share price. Paytm insider says “Digital India campaign is the best example of this.”

Risks to consider according to Paytm insider:

As with any investment, there is risk involved in buying Paytm shares. External factors such as changes in government policies, increased competition or economic ups and downs. And its fluctuations may affect the profitability of the company and, in turn, may affect the Paytm share price. Investors should be aware of the potential risk associated with the digital payment industry. They are changing market conditions and uncertainties that may affect the company’s performance.

Long-Term Perspective of Paytm Share Price:

Investing in individual stocks always comes with risk, and it is important to maintain a diversified investment portfolio to spread the risk effectively. Investors should consider their financial goals and deadlines when deciding on Paytm as an investment option. Paytm diversified e-commerce and financial products, increasing Paytm share price. Market trends and competition influenced Paytm share price. Continued technological innovations and strategic partnerships boosted the confidence of investors. Paytm’s revenue growth affected its share valuation. Changing regulations in the financial sector affected Paytm share price.

conclusion :

Paytm share price prospects depend on various factors including company performance, industry trends and market sentiment. As with any investment decision, thorough research, consultation with financial advisors and a long-term perspective are important. While the growth prospects of Paytm in India’s digital payments market are promising, investors should carefully consider the risks and benefits before making any investment decision. In the end, As a Paytm insider I would say, Paytm is an attractive investment option for you.